US Tariffs a Big Threat to Indian Stock Market? Risks, Sector Impact and Future Outlook Explained

US tariffs up to 50% may hit Indian equities, rupee, and GDP growth. Check risks, sector impact, expert views and future outlook for investors.

India’s stock market, one of the best-performing emerging markets in recent years, now faces a significant external challenge – the proposed U.S. tariffs, which could go as high as 50% headline rate and average 36% after exemptions. According to a recent note by Capital Economics, this move poses a “big threat” to Indian equities, potentially denting GDP growth, foreign investments, and corporate earnings.

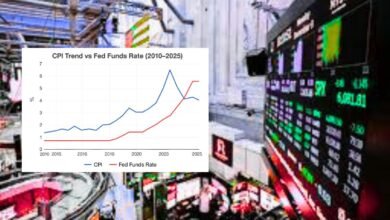

The announcement comes at a time when Indian equities are trading at premium valuations, making them highly sensitive to global shocks. Since late June, both the Indian rupee and benchmark indices have shown signs of weakness after U.S. President Donald Trump ramped up criticism of India’s trade practices.

In this article, we break down the risks, sectoral impact, historical parallels, and what investors should watch if the proposed tariffs move forward.

Why the U.S. Tariff Proposal Matters for India

India’s economy is heavily reliant on global trade, with the U.S. being one of its largest export destinations. Sectors such as pharmaceuticals, textiles, IT services, and chemicals contribute significantly to the export basket.

If tariffs of this scale (36–50%) are implemented, it could directly affect:

- Export revenues, especially for price-sensitive industries.

- Corporate earnings, since many companies rely on the U.S. for growth.

- Investor sentiment, as higher tariffs raise uncertainty.

- Rupee stability, because weaker exports reduce foreign inflows.

The proposed tariffs are not just a trade barrier; they are a strategic risk that could shift global supply chains.

Market Reaction So Far

Despite the noise, the overall market impact has been limited till now. Analysts believe this is because investors are betting on eventual exemptions or softer final tariff rates.

- Textiles: Already seeing double-digit stock declines, but with only a 2% weight in the market, the broader index has held steady.

- Pharmaceuticals: Despite being heavily dependent on U.S. exports, pharma has seen only modest corrections, partly due to hopes of exemptions and low price elasticity of drugs.

- Rupee: The currency has weakened against the dollar, reflecting investor caution.

But experts caution that this calm may not last. If optimism fades and tariffs are implemented fully, markets could see a sharp downside correction.

Historical Lessons – Why Optimism Could Be Misplaced

History shows that even a small slowdown in GDP growth has often translated into steeper corporate earnings decline.

- In past global trade disruptions, a 1% dip in GDP growth has led to a 5–7% drop in earnings growth.

- With current proposals, India’s GDP growth could be cut by 1.5 percentage points over two years.

- The impact would be worse for companies in export-heavy sectors, which rely on the U.S. market for demand.

This disconnect between macroeconomic data and corporate earnings is a key reason why the market could be underestimating the risk.

Valuations: A Double-Edged Sword

One of the biggest concerns highlighted by analysts is India’s high valuations. The MSCI India Index remains expensive compared with other emerging markets, even after recent corrections.

Factors supporting high valuations include:

- Strong domestic retail participation.

- Stable political environment.

- Expectations of robust earnings growth.

- Perception of India as a beneficiary of U.S.-China trade tensions.

However, if India itself becomes a direct target of U.S. trade restrictions, this bullish narrative could quickly collapse.

Sectoral Impact of U.S. Tariffs

1. Textiles and Apparel

- Already under pressure with double-digit declines.

- Highly price-sensitive sector, vulnerable to higher duties.

- Could lose competitiveness to countries like Vietnam and Bangladesh.

2. Pharmaceuticals

- Larger sector weight but has been resilient so far.

- Drugs are less price-sensitive; however, long-term margins may come under pressure.

- U.S. FDA regulatory environment already poses challenges.

3. IT Services

- While not directly tariff-driven, secondary effects such as weaker global demand and slower outsourcing could hit revenue.

- IT companies rely on U.S. clients for 60–65% of earnings.

4. Automobiles and Auto Components

- Tariffs could affect export of auto parts to the U.S.

- A slowdown in global trade may hit India’s auto exports indirectly.

5. Agriculture and Chemicals

- Chemicals and agro products may face higher duties, reducing competitiveness.

- Could impact small and mid-cap companies that rely heavily on exports.

Broader Economic Impact

Capital Economics estimates that sustained tariffs could lead to:

- 1.5% lower GDP growth over two years.

- Weaker foreign direct investment (FDI) inflows.

- Pressure on corporate earnings and EPS targets.

- Higher volatility in equity markets and the rupee.

This means the stock market underperformance could extend into the medium term, with India lagging behind other Asian peers like China and Taiwan, where valuations are relatively cheaper.

Future Outlook – What Investors Should Watch

- Tariff Negotiations: Final rates could be lower than proposed, offering relief.

- Exemptions: Sectors like pharmaceuticals may still secure exemptions.

- Global Sentiment: If the U.S.-China trade war eases, India could regain some positive momentum.

- Valuations: Continued premium valuations make the market vulnerable to global shocks.

- Policy Response: Indian government may need to step in with stimulus or trade agreements to cushion the blow.

Investor Takeaways – Strategy Ahead

- Short-term: Expect volatility and potential downside if tariffs are implemented.

- Medium-term: Market likely to underperform relative to global peers.

- Sectors to Avoid: Textiles, chemicals, and highly export-dependent midcaps.

- Sectors to Watch: Pharmaceuticals (possible exemptions), domestic-focused sectors like FMCG and banking.

- Valuation Caution: Avoid chasing high-valuation stocks without earnings visibility.

The proposed U.S. tariffs are more than just a policy headline; they represent a structural risk to India’s trade, earnings growth, and market sentiment. While investor optimism has kept markets relatively stable so far, the reality is that tariffs of this scale could shave off GDP growth, weaken the rupee, and dampen corporate earnings.

Unless exemptions or softer final rates emerge, Indian equities could see a sharper correction in the coming months. For investors, the focus should be on risk management, sector rotation, and maintaining a cautious stance on overvalued stocks.