The Upper Circuit Paradox: Why is Waaree Selling its Golden Goose, Indosolar, Amidst a Buying Frenzy? A 10,000-Word Investigation

A Deep Dive into the SEBI Mandate, the Solar Power Gold Rush, and the High-Stakes Turnaround Story That Has Investors Baffled and Intrigued. Is This a Red Flag or a Hidden Opportunity

A Scene of Manic Joy, and a Baffling Announcement

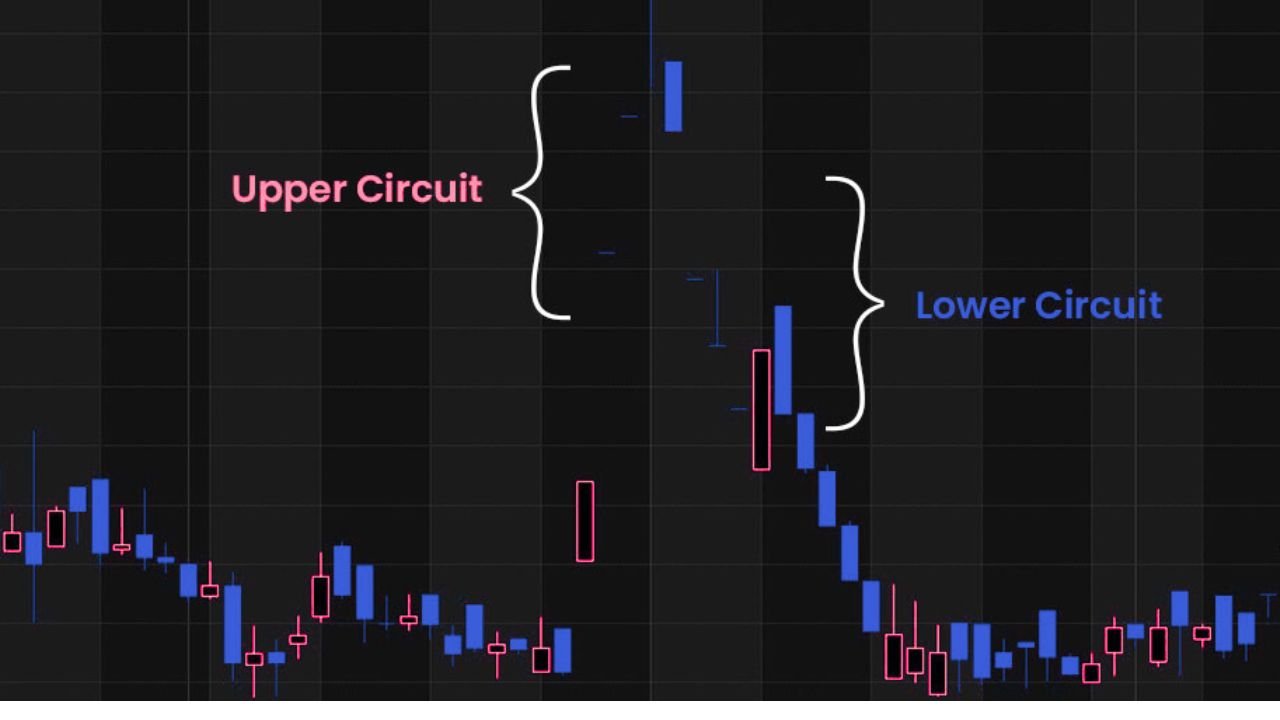

Picture the scene on the trading screen. It’s a theatre of pure, unadulterated euphoria. The stock is Indosolar Limited. The script for the past several days, even weeks, has been the same predictable, yet exhilarating, one-act play. The moment the market opens, a tsunami of buy orders floods the system. The stock price doesn’t climb; it leaps. It instantly hits its upper limit, the ‘upper circuit’ of 4.99%, and freezes there for the rest of the day.

The screen tells a story of insatiable demand. A queue of pending buy orders stretches into the virtual distance—562,825 shares, to be precise—all desperately waiting for a seller. But there are none. The seller’s column is stark, empty, a ghost town. It seems everyone who owns a piece of Indosolar believes they are holding onto a rocket ship, and they have no intention of getting off. The stock has just touched its 52-week high of ₹359.95, a new peak in its dizzying ascent. For retail investors who got in early, it’s a time of celebration, of watching their wealth multiply in a way that seems almost magical.

And then, right in the middle of this wild party, an announcement drops like a bucket of ice water.

Waaree Energies Limited, the promoter of Indosolar, its parent company and one of the biggest names in India’s solar industry, formally proposes to sell 1,250,000 equity shares of the company. This represents a significant 3% of Indosolar’s total paid-up capital.

The market paused. The collective cheer of the bulls caught in their throats. The announcement was a riddle wrapped in a paradox. On one hand, you have a stock so hot that half a million shares are waiting in line to be bought, with no one willing to sell. On the other hand, the company’s own creator, its promoter, is stepping forward to sell a massive chunk of it. It’s akin to discovering a gold mine and, just as the gold rush begins, the original prospector starts selling off pieces of his map.

This single act sparked a thousand questions in the minds of investors, both seasoned and new:

Why would Waaree Energies do this? Have they lost faith in Indosolar’s spectacular rally?

Is this a sign that the “smart money” is cashing out, a warning bell for small investors to book their profits and run?

Or is there another, deeper layer to this story, a strategic reason that isn’t immediately obvious from the screaming buy signals on the screen?

This article is not just an analysis of a news clipping. It is a deep, investigative journey to find the answer to that fundamental “Why?”. In this mega-analysis, we will assemble every piece of this puzzle. We will venture into the intricate, often misunderstood, world of SEBI regulations that are the true driving force behind this sale. We will explore the complex relationship between Waaree and Indosolar—a story of acquisition, turnaround, and ambition. We will place this entire episode within the grander context of India’s solar energy revolution. And finally, from an investor’s perspective, we will attempt to discern if this moment represents a grave danger or a unique opportunity. So, fasten your seatbelts, because we are about to dissect not just a stock, but a story at the very heart of India’s green energy future.

Chapter 1: The Regulator’s Mandate – The Real Reason Waaree is Selling

Before we dive into any speculation about Waaree’s motives, we must first understand the most powerful character in this story, the one pulling the strings from behind the curtain: the Securities and Exchange Board of India (SEBI). Waaree Energies’ decision to sell Indosolar shares is not born from fear or a lack of confidence. It is a direct and necessary action to comply with one of SEBI’s most critical regulations for listed companies: the Minimum Public Shareholding (MPS) norms.

1.1 What Exactly is Minimum Public Shareholding (MPS)?

In simple terms, the MPS rule mandates that every company listed on the Indian stock exchange must ensure that at least 25% of its total shares are held by the public. The “public” here refers to all shareholders who are not part of the promoter group. This includes retail investors (like you and me), mutual funds, insurance companies, Foreign Institutional Investors (FIIs), and other non-promoter entities.

This means that the promoters (the founders or the controlling entity) of any listed company cannot hold more than 75% of the company’s stake. They are legally obligated to let the public own at least a quarter of their company.

1.2 Why Did SEBI Create This Rule? What’s the Grand Purpose?

SEBI didn’t introduce this rule to make life difficult for promoters. It was implemented with a clear, long-term vision to make the Indian stock market more robust, transparent, fair, and democratic. The motivations behind it are profound:

To Improve Corporate Governance: When promoters hold 90% or 95% of a company, it can operate like a private fiefdom. Decisions are made unilaterally, and the voice of minority shareholders (those with a small stake) is often ignored. A 25% public float ensures a larger, more diverse base of shareholders who can act as a check on the management, demand accountability, and push for better corporate governance standards.

To Ensure Fair Price Discovery: When a stock’s shares are concentrated in just a few hands (the promoters), its price can be easily manipulated. A small transaction of a few thousand shares can cause wild swings. When 25% of the shares are freely traded among the public, the volume of transactions increases significantly. This constant buying and selling helps the market discover the stock’s true, intrinsic value.

To Increase Liquidity: Liquidity is the ease with which a stock can be bought or sold. Stocks with very low public shareholding are often “illiquid.” If you want to buy, you can’t find a seller. If you want to sell, you can’t find a buyer. The current situation in Indosolar, with only buyers and no sellers, is a perfect example of the problems of low liquidity. Forcing a 25% public float ensures that there are enough shares available in the market for trading, making it easier for investors to enter and exit their positions.

To Curb Speculation and Manipulation: Stocks with a very small “free float” (the portion of shares available for public trading) are prime targets for market manipulators and speculators. They can easily corner the available shares and artificially inflate the price, trapping unsuspecting retail investors at the top. A larger free float makes such manipulation much more difficult and expensive.

1.3 The Compulsion to Comply: Not a Choice, but a Necessity

For companies that don’t meet this 25% public shareholding requirement, SEBI provides a specific timeline to comply. Failure to do so can lead to severe penalties, including hefty fines, freezing of promoter shares, and in extreme cases, even suspension of trading or delisting of the stock.

Therefore, Waaree Energies’ sale of 12.5 lakh shares is not a strategic market call. It is a regulatory compulsion. They are not selling because they want to, but because they have to in order to meet SEBI’s deadline and bring their shareholding in Indosolar down to the 75% threshold, thereby increasing the public shareholding to 25%. This single piece of information reframes the entire narrative. The promoter isn’t abandoning a rising star; they are simply following the law of the land.

Chapter 2: The Turnaround Story – The History and Relationship of Waaree and Indosolar

To fully grasp the current situation, we need to rewind the clock. The relationship between Waaree Energies and Indosolar isn’t that of a parent and a naturally born child. It’s more akin to an adoption, a rescue mission that is now blossoming into a strategic masterstroke.

2.1 Who is Waaree Energies? The Solar Behemoth

First, let’s establish the identity of the promoter. Waaree Energies is not a small player. It is a titan of the Indian solar industry. Founded in 1989, it has grown to become India’s largest manufacturer of solar PV modules with a massive manufacturing capacity. They are a fully integrated player with a presence across the entire solar value chain, from manufacturing cells and modules to executing large-scale solar power projects (EPC) and a growing retail presence. Waaree is a respected, established, and powerful name in India’s green energy landscape. This is crucial because it means the entity behind Indosolar has deep pockets, immense technical expertise, and a long-term vision.

2.2 Who was Indosolar? The Pre-Acquisition Story

Indosolar, on the other hand, had a more troubled past. It was one of India’s early solar cell manufacturers. However, it struggled to compete with the flood of cheaper imports, particularly from China, and faced significant financial distress. The company piled up debt, its operations faltered, and it was eventually dragged into insolvency proceedings under the National Company Law Tribunal (NCLT), which is India’s bankruptcy court.

2.3 The Strategic Acquisition: A Phoenix from the Ashes

This is where Waaree Energies entered the picture. In 2022, Waaree acquired Indosolar through the NCLT process. This wasn’t just a random purchase; it was a highly strategic move. By acquiring Indosolar’s manufacturing assets, Waaree was able to:

Vertically Integrate: Gain control over the manufacturing of solar cells, a critical component in the solar module supply chain. This reduces their dependence on external suppliers.

Expand Capacity Quickly: Acquiring existing facilities is often faster and cheaper than building brand new ones from scratch.

Capitalize on Government Policy: This is the most important part. The Indian government, determined to reduce its reliance on Chinese imports and build domestic manufacturing capabilities, had launched the Production-Linked Incentive (PLI) scheme for solar manufacturing. Waaree knew that by reviving and scaling up Indosolar’s assets, it could become a major beneficiary of these government incentives.

(Disclaimer: This article is for informational and educational purposes only. It does not constitute financial advice or a recommendation to buy or sell any securities. Please consult with a qualified financial advisor before making any investment decisions.)