Stocks Rally on Tame Inflation Data — Fed Rate Cuts Back on the Table

Markets cheered a cooler-than-expected inflation report, fueling hopes for multiple Federal Reserve rate cuts this year.

U.S. stocks surged as July CPI cooled, boosting hopes for Fed rate cuts. Full market analysis, sector impact, historical trends, and investor strategies for 2025.

U.S. Markets React to July Inflation Data

Tuesday’s U.S. stock market session brought a welcome relief to investors as inflation data for July came in slightly softer than expectations.

- Dow Jones Industrial Average (DJIA): Rose 253 points (+0.6%)

- S&P 500: Gained 0.4%

- Nasdaq Composite: Added 0.4%, briefly touching a new intraday high before settling slightly lower

The positive mood stemmed from the U.S. Consumer Price Index (CPI), which increased 2.7% year-over-year in July, compared with the 2.8% forecast. Core CPI, which excludes volatile food and energy prices, rose 3.1%, just above the 3% estimate.

The headline reading signaled a cooling in price pressures, giving hope that the Federal Reserve might ease monetary policy in the coming months.

Breaking Down the Inflation Report

Headline CPI vs Core CPI — Why It Matters

- Headline CPI: Measures the overall change in the cost of goods and services, including food and energy.

- Core CPI: Strips out these volatile categories to provide a clearer view of underlying inflation trends.

In July’s case:

- Headline CPI was slightly below expectations — a bullish signal for equities.

- Core CPI, however, came in a touch higher, indicating that inflation pressures remain in certain categories like housing and healthcare.

Implication: The Federal Reserve will need to weigh this mixed picture carefully.

Federal Reserve Policy Outlook

According to the CME FedWatch Tool:

- Markets now price in a 91% chance of a rate cut in September (up from 85% before the data).

- Traders have also increased bets on October and December cuts.

Why it matters:

- Rate cuts lower borrowing costs, boost corporate earnings, and make equities more attractive.

- But premature or excessive easing could reignite inflation later.

Historically, the Fed has reacted swiftly when inflation shows consistent signs of cooling — especially during periods of slowing global growth.

Impact of Tariff Pause on Markets

President Donald Trump announced a 90-day pause on higher tariffs for Chinese imports.

This has three immediate effects:

- Reduces inflationary pressure from imported goods.

- Boosts sentiment in manufacturing and consumer goods sectors.

- Improves short-term trade relations with China, calming market volatility.

However, the pause is temporary — if negotiations stall, tariffs could resume.

Sector-by-Sector Analysis

| Sector | Performance | Key Driver |

|---|---|---|

| Tech | +0.8% | Nasdaq strength, optimism on growth |

| Financials | +0.5% | Rate cut prospects lift lending outlook |

| Industrials | +0.6% | Tariff pause improves demand expectations |

| Consumer Discretionary | +0.7% | Lower inflation supports spending |

| Energy | -0.3% | Oil prices fell on oversupply concerns |

Investor Sentiment and Trading Trends

- Options Market: Increased demand for bullish call options signals rising confidence.

- Bond Yields: 10-year Treasury yield dipped as traders priced in easier Fed policy.

- U.S. Dollar: Slightly weaker, benefiting exporters and commodity producers.

Investor mood has shifted from fear of tightening to anticipation of easing.

Historical Perspective: Rate Cuts After Inflation Drops

- 1995: CPI slowed, Fed cut rates, markets rallied for multiple years.

- 2001: Fed cuts in response to recession risk stabilized markets after initial turbulence.

- 2019: CPI cooled amid trade war; Fed delivered three cuts, boosting equities into 2020.

Pattern: Rate cuts often extend bull markets, but timing is critical.

Risks That Could Derail the Rally

- Re-acceleration of Core Inflation — could force the Fed to reverse course.

- Geopolitical Tensions — tariffs could return quickly if talks with China falter.

- High Equity Valuations — leaves market vulnerable to earnings disappointments.

Global Market Reactions

- Europe: STOXX 600 rose 0.5% on U.S. optimism.

- Asia: Mixed performance; Chinese equities flat as domestic slowdown concerns linger.

- Emerging Markets: Currencies gained as the U.S. dollar weakened.

Long-Term Investment Strategies Amid Policy Shifts

- Growth Stocks — Benefit from cheaper capital when rates fall.

- Dividend Stocks — Attractive for income in a lower-yield environment.

- Gold & Commodities — Hedge against unexpected inflation rebound.

- Defensive Sectors — Healthcare and utilities for downturn protection.

Upcoming Economic Reports to Watch

- Thursday: Producer Price Index (PPI) for wholesale inflation trends

- Late August: Jackson Hole Economic Symposium for Fed signals

- September: FOMC meeting, potential start of the easing cycle

Expert Opinions and Analyst Forecasts

Brent Schutte, CIO at Northwestern Mutual Wealth Management, warns:

“The degree of tariff impacts and how long they will take to work through the economy remain open questions.”

Conclusion — Navigating the Road Ahead

The July CPI report has boosted optimism, but core inflation’s resilience and uncertain trade policies keep risks alive.

For now, the market is in a sweet spot: cooling inflation, supportive policy outlook, and strong earnings expectations.

Investors should stay diversified and watch upcoming Fed communications closely.

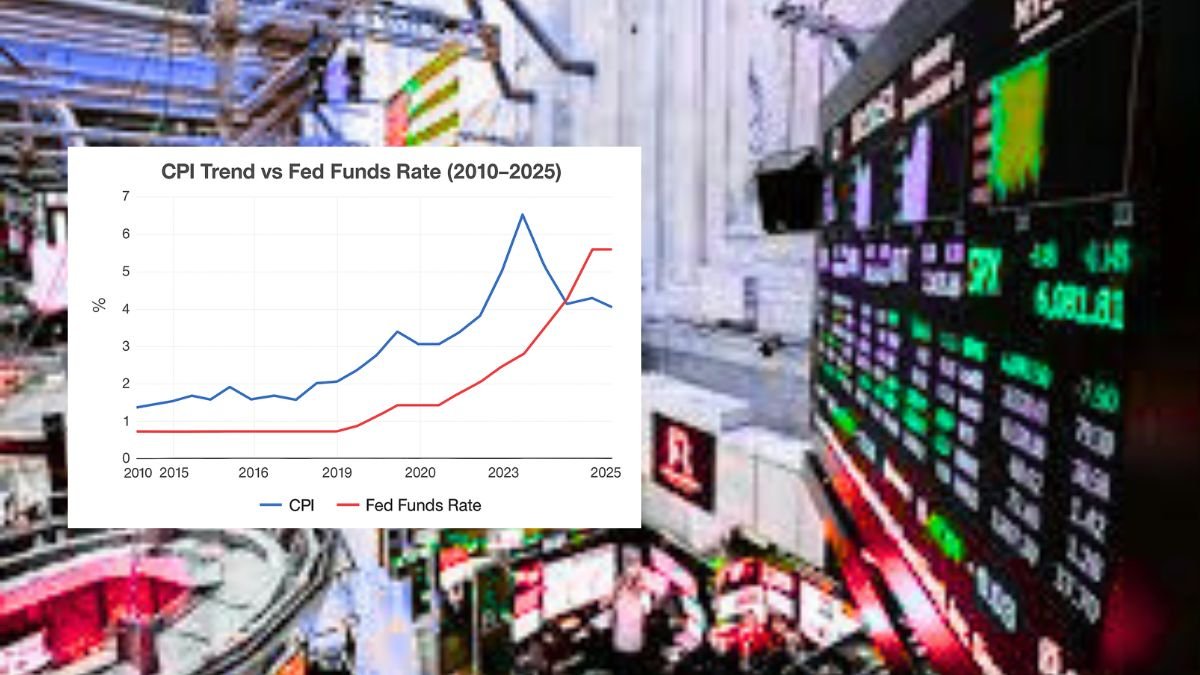

Chart: CPI Trend vs Fed Funds Rate (2010–2025)

| Year | CPI (%) | Core CPI (%) | Fed Funds Rate (%) |

|---|---|---|---|

| 2010 | 1.6 | 1.0 | 0.25 |

| 2015 | 0.1 | 1.8 | 0.25 |

| 2019 | 1.8 | 2.3 | 2.25 |

| 2023 | 6.5 | 5.7 | 4.50 |

| 2025 | 2.7 | 3.1 | 5.25 |