Indian Stock Market Today: Nifty 50, Sensex Open Higher on Cooling Inflation; Analysts Recommend Paytm, M&M, MCX for Short-Term Gains

Lower retail inflation, strong global cues, and sector resilience lift investor sentiment; key levels and top stock picks for August 2025.

Indian stock markets opened higher as Nifty 50 nears 24,600; lower inflation boosts sentiment. Key stock picks include Paytm, M&M, MCX.

Indian Stock Market Today: Nifty 50, Sensex Open Higher on Cooling Inflation; Paytm, M&M, MCX in Focus

The Indian equity markets kicked off Wednesday’s trading session on a positive note as Nifty 50 and Sensex climbed higher, driven by optimism from India’s lowest retail inflation in eight years and supportive global cues.

As of 10:43 AM IST on 13 August 2025, the Nifty 50 was up 0.35% at 24,572.85, while the BSE Sensex rose 0.22% to 80,415.06. Investor confidence was bolstered by a combination of lower consumer price index (CPI) figures, expectations of accommodative monetary policy, and signs of stability in U.S. inflation data.

Cooling Inflation Gives Bulls a Boost

India’s retail inflation rate fell to just 1.55% in July 2025, well below the Reserve Bank of India’s 2%–6% tolerance range. The drop was mainly due to easing food prices, which had previously been a major driver of headline inflation.

Market analysts say this steep decline gives the RBI more room to maintain a dovish policy stance, potentially supporting both equity and bond markets in the short term.

“Lower CPI numbers are a direct tailwind for equities because they reduce the probability of near-term rate hikes and help improve corporate earnings visibility,” noted Sagar Doshi, Senior Vice President – Research at Nuvama Professional Clients Group.

Key Technical Levels for Nifty 50 & Bank Nifty

- Nifty 50: Facing resistance at the 24,700–24,750 zone, aligned with a downward trendline. A closing above 24,800 could trigger a fresh bullish wave, while downside support lies at 24,200, with the 200-DMA near 24,000 acting as a critical floor.

- Bank Nifty: Currently following a sell-on-rise pattern. A breakout above 55,800 on a closing basis would suggest a strong upside trend, while 54,000–54,300 remains the next major support zone.

Global Market Cues – U.S.-Russia Talks, Soft U.S. Data, Japan Bonds Sell-off

- U.S.-Russia Meeting: Later this week, U.S. President Donald Trump is scheduled to meet Russian President Vladimir Putin in Alaska. While expectations for a quick Ukraine conflict resolution are low, markets are monitoring geopolitical headlines for potential volatility.

- U.S. Inflation: Mild U.S. CPI data has strengthened bets for a September Federal Reserve rate cut, helping global equities and commodities.

- Japan Bonds: A weak five-year Japanese government bond auction triggered a sell-off, with yields hitting multi-year highs. This underscores global bond market fragility, which can indirectly impact emerging market flows.

Sector Snapshot – Autos, IT, Commodities in Focus

- Auto Sector: M&M is leading gains, trading near all-time highs after fully recovering losses from the past year. A breakout above ₹3,280 could accelerate gains.

- IT Sector: Stable but cautious as investors await U.S. tech earnings and commentary on AI investments.

- Commodities: MCX shares surged after breaking out from consolidation, with analysts expecting a quick move towards all-time highs.

Stock Picks for Wednesday – Analyst Recommendations

1. Paytm (One 97 Communications Ltd)

- LCP: ₹1,120

- Stop Loss: ₹1,080

- Target: ₹1,280

- Rationale: Near 3-year highs, momentum boosted by strong Q1 results and RBI approval for Paytm Payments Services to operate as an online payment aggregator.

2. Mahindra & Mahindra (M&M)

- LCP: ₹3,236

- Stop Loss: ₹3,115

- Target: ₹3,550

- Rationale: Strong resilience in the auto sector, constructive chart patterns, and proximity to all-time highs.

3. Multi Commodity Exchange of India (MCX)

- LCP: ₹8,151

- Stop Loss: ₹7,820

- Target: ₹8,800

- Rationale: Breakout from consolidation with strong volumes, positive trend continuation expected.

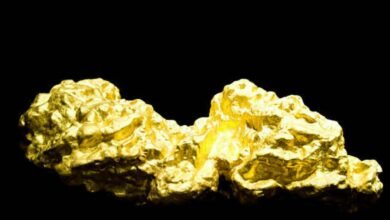

H2: Gold Prices Edge Higher on Weak Dollar

- Spot Gold: $3,351.46/oz (+0.2%)

- U.S. Gold Futures: $3,399.60/oz (flat)

- Domestic MCX Gold (Oct Contract): ₹1,00,236 per 10g (+0.08%)

Weak U.S. inflation data and a softer dollar have supported gold, though upside may be capped until geopolitical uncertainties resurface.

Sensex 1 Lakh by Independence Day 2026?

Reaching 1,00,000 on the Sensex would require a 25% rally in one year from current levels (~80,235). Morgan Stanley’s bull case scenario sees this achievable by June 2026, driven by earnings growth, policy reforms, and FII inflows.

However, risks include:

- Geopolitical flare-ups

- Global bond market instability

- Potential U.S. recession

Market Outlook – Short-Term vs Medium-Term

- Short-Term: Expect volatility around global event headlines and technical resistance zones.

- Medium-Term: Earnings upgrades, lower inflation, and strong domestic demand could keep Indian equities in an uptrend.

Investor Takeaways

- Watch 24,800 on Nifty 50 and 55,800 on Bank Nifty for confirmation of a bullish breakout.

- Lower inflation is a tailwind but global uncertainty remains a risk.

- Stock-specific action (Paytm, M&M, MCX) could outperform indices in the near term.

- Keep an eye on RBI policy commentary and U.S.-Russia talks later this week.