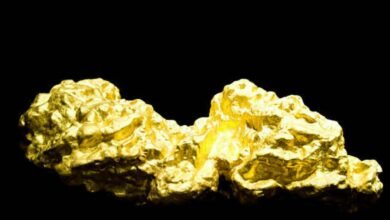

Gold and Silver Prices Dip in India Amid Global Market Gains; Check Rates in Your City

24-carat gold slips ₹10 to ₹1,01,340 per 10 grams; silver falls ₹100 per kg even as global prices edge higher.

Gold and silver prices fell in India on August 14, 2025, despite a rise in global markets. Check today’s rates for 22K & 24K gold and silver in major cities, plus market analysis.

Gold and Silver Prices Decline in India, August 14, 2025

In early Thursday trade, gold prices in India edged lower even as global precious metal markets saw a modest uptick. According to data from the GoodReturns website, the price of 24-carat gold fell by ₹10, with ten grams selling at ₹1,01,340.

Similarly, silver prices dropped by ₹100 per kilogram, trading at ₹1,14,900 in key Indian cities.

Domestic Gold Price Update

24-Carat Gold Prices (per 10 grams)

- Mumbai, Kolkata, Chennai: ₹1,01,340

- Delhi: ₹1,01,490

22-Carat Gold Prices (per 10 grams)

- Mumbai, Kolkata, Bengaluru, Chennai, Hyderabad: ₹92,890

- Delhi: ₹93,040

Domestic Silver Price Update

Silver Prices (per kilogram)

- Delhi, Mumbai, Kolkata: ₹1,14,900

- Chennai: ₹1,24,900

Global Precious Metals Market

Despite the minor dip in Indian prices, international gold prices rose for a third consecutive session on Thursday, supported by a weaker US dollar and lower Treasury yields.

- Spot gold: Up 0.4% to $3,368.99/oz (as of 01:21 GMT)

- US gold futures (Dec delivery): Up 0.3% to $3,417.80/oz

- Spot silver: +0.2% at $38.56/oz

- Platinum: -0.1% at $1,338.33/oz

- Palladium: +1.3% at $1,136.70/oz

The gains in global gold are largely driven by increased market expectations of a US Federal Reserve interest rate cut in September 2025, which generally supports non-yielding assets like gold.

Why Indian Gold Prices Fell Despite Global Gains

Indian gold and silver prices are influenced by:

- Global spot and futures market trends

- Rupee–US dollar exchange rate

- Local demand and supply conditions

- Import duties and government policies

The slight dip in domestic rates today could be due to currency movement and profit booking after recent gains.

Investor Outlook

Short-Term:

- Any confirmation of a US interest rate cut could boost global gold prices further.

- Domestic prices may track global gains if the rupee remains stable.

Medium-Term:

- Festive and wedding season demand in India (starting September–October) could drive buying interest, potentially pushing prices higher.

Long-Term:

- Ongoing global economic uncertainties and central bank buying trends may keep gold and silver in demand as safe-haven assets.

While gold and silver prices in India dipped slightly on August 14, 2025, the overall market sentiment remains positive, especially if the US Fed moves toward policy easing. For long-term investors, current levels could still present accumulation opportunities ahead of the festive season.